We close the gap between opportunity and funding

Tasaheel makes it easy for payment providers and POS companies to offer instant funding to their merchants — seamlessly

Tasaheel enables POS providers to unlock new revenue streams and boost merchant retention by embedding smart, data-driven funding directly into their platforms. For funders, we offer seamless access to a high-quality, underbanked SME segment — with real-time risk insights and repayment via daily transaction flows.

About us

Tasaheel is a Saudi fintech company transforming how SMEs access working capital. Through Tasaheel Connect™, we embed funding directly into POS systems and payment platforms, enabling merchants to get financed instantly — with zero paperwork.

Founded by fintech experts, we bridge the gap left by traditional lenders using real-time data, a seamless user experience, and a partner-first approach.

What Makes Us Different

Embedded by Design: Our solution integrates directly into POS and payment platforms for a native user experience.

Data-Driven Decisions: We leverage real-time transaction data for faster, fairer funding decisions.

Aligned with Partners: We help platforms grow revenue while supporting the success of their merchant base.

Fully Customizable: Our infrastructure can be white-labeled and tailored to suit partners’ branding and compliance needs.

Why Partner with Tasaheel?

Connecting the ecosystem to power SME growth

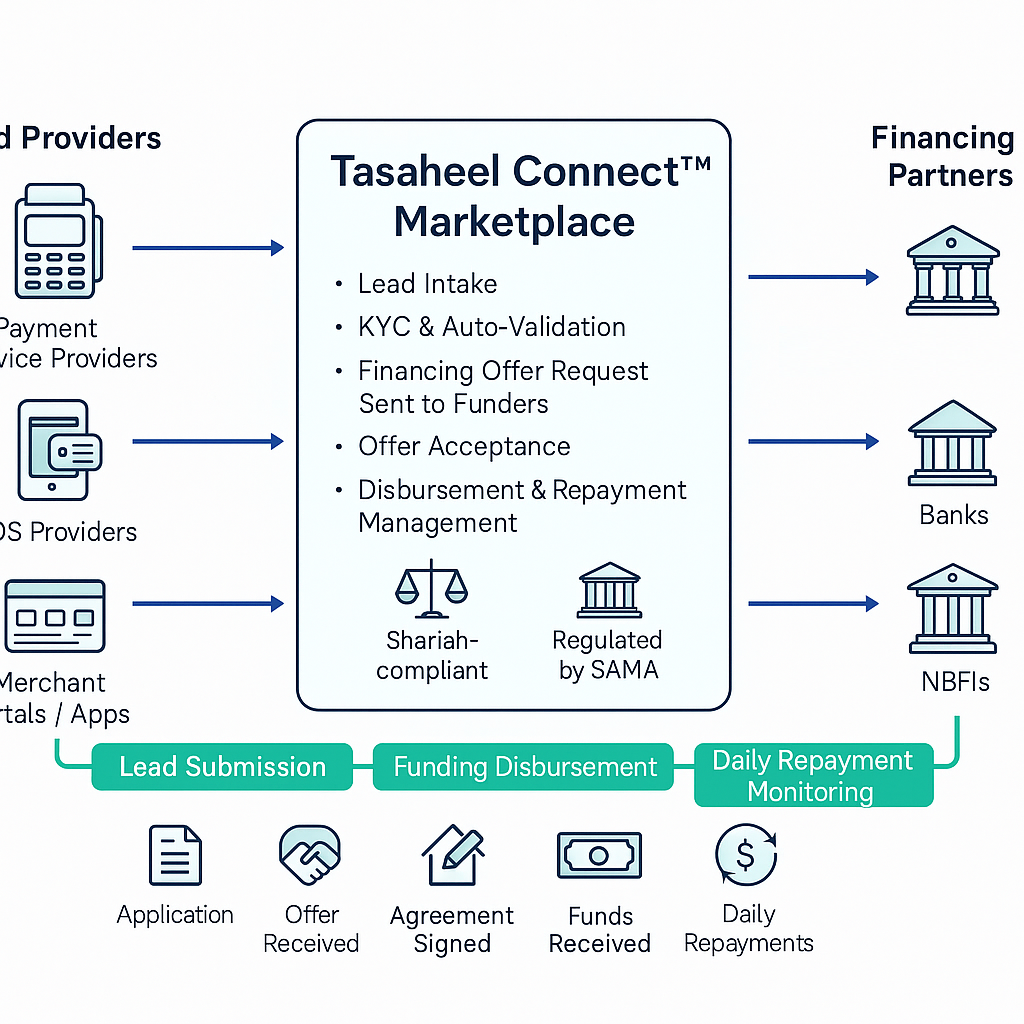

Built as a Marketplace

We’re not just a funding solution — we’re the infrastructure connecting all sides. Tasaheel brings SMEs, POS platforms, and funders together under one unified platform, creating a seamless flow of capital, data, and value.

Helping SMEs Grow

We make capital simple, fast, and accessible for underbanked merchants. Our embedded model meets SMEs where they are — inside their daily tools — enabling growth without paperwork, complexity, or friction.

Powering Platform Revenue

We help POS companies unlock new revenue and boost merchant loyalty. By offering finance as a native feature, platforms increase stickiness, stand out from competitors, and tap into new income streams — effortlessly.

Smarter Deal Flow for Funders

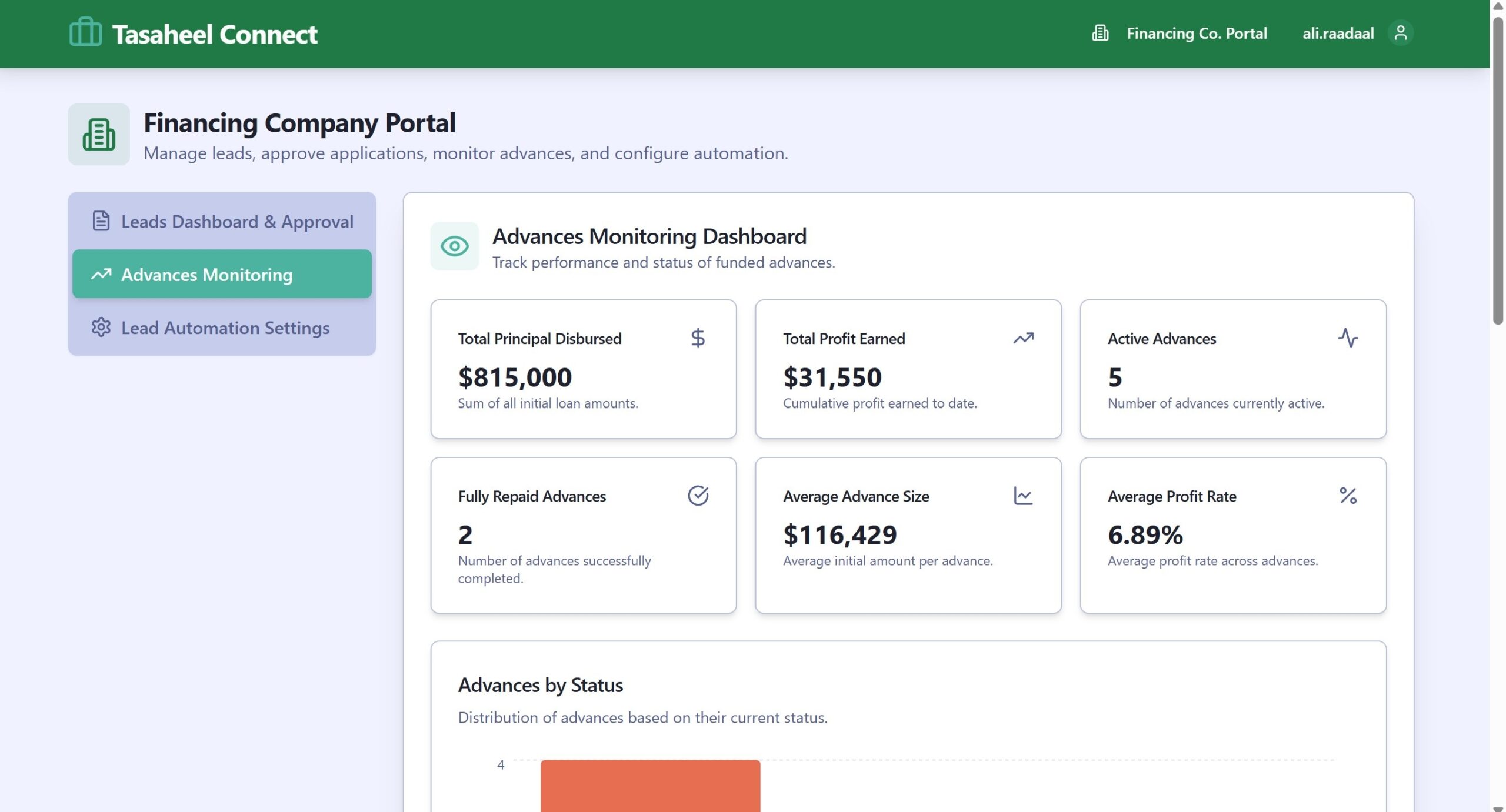

We deliver high-quality, low-risk SME leads at scale. Our platform connects funders to pre-vetted merchants with real-time data, ensuring faster decision-making and stronger portfolio performance — all at a lower acquisition cost.

Our products

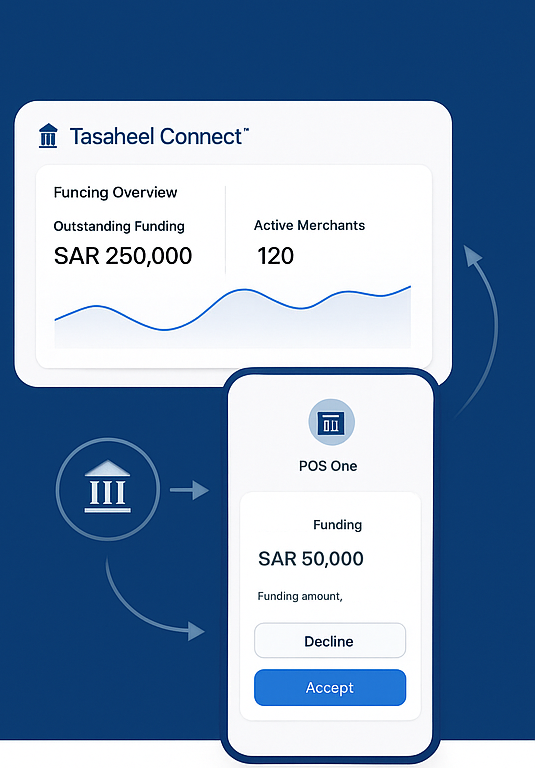

Tasaheel Connect™

Tasaheel Connect™ is a smart marketplace and lead management portal that connects payment service providers with a network of vetted financing partners.

- Payment service providers can submit funding leads via a user-friendly dashboard, web

form, or API integration—no development-heavy integration required. - Financing partners receive real-time notifications when new leads are submitted and

can respond with automated funding offers. - Once a merchant accepts an offer, the portal manages the entire journey—from

document upload to payout. - Built-in tools calculate daily repayment schedules, monitor payment performance,

and handle post-disbursement communication—all in one centralized platform.

Plug into a Ready-Made Marketplace of Pre-Vetted Borrowers

- Gain access to high-quality financing leads from a new client segment.

- Increase your financing portfolio at low acquisition cost.

- Reduced credit risk without collateral.

- Repayment collected automatically through payment channel

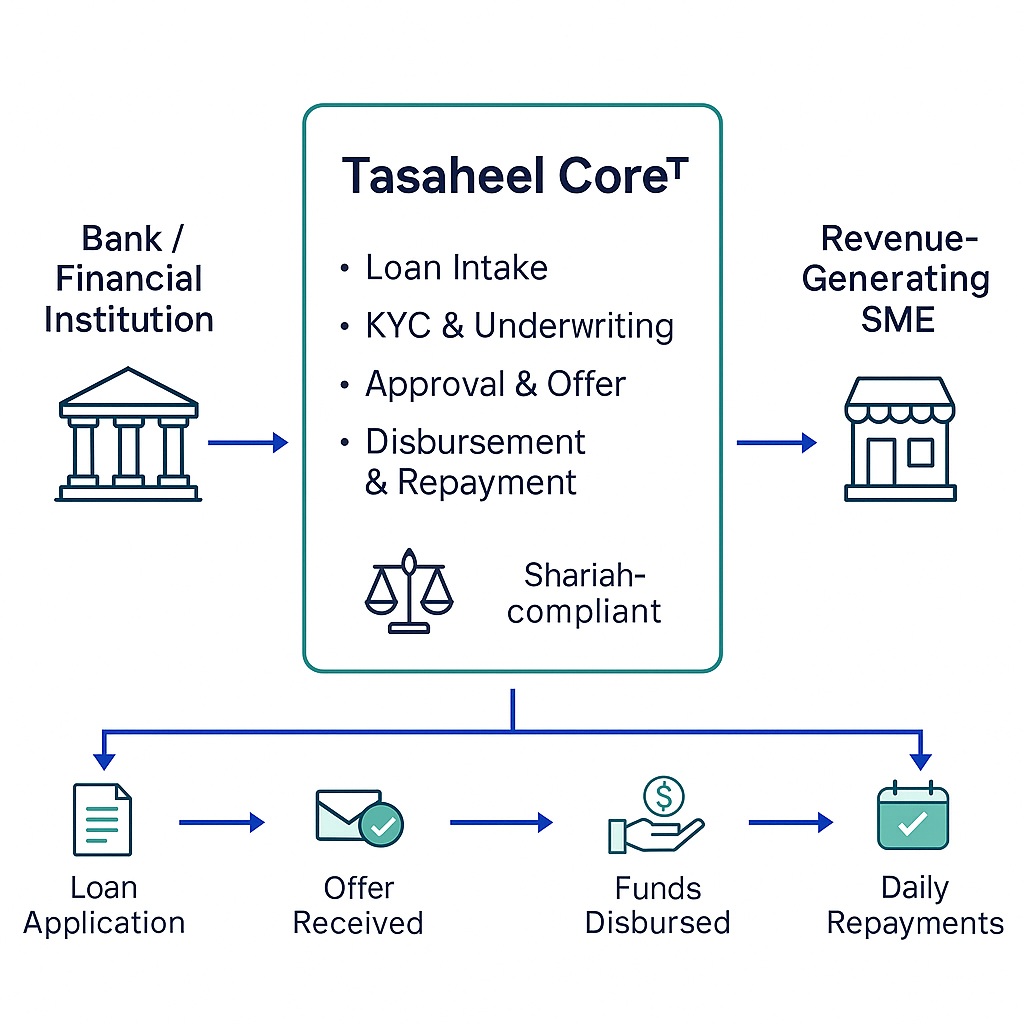

Tasaheel Core™

funding to their SME clients—without overhauling existing infrastructure:

- Seamlessly integrates into the bank’s digital channels (mobile apps, online banking).

- Uses Tasaheel’s proprietary AI underwriting engine to assess risk and approve funding

based on revenue data, not just credit scores. - Enables banks to offer Shariah-compliant, revenue-based finance under their own

brand. - Delivers a digital-first experience with minimal paperwork, same-day decisions, and

automated repayment tracking

One platform. Infinite value — for funders, platforms and SMEs

How we are mitigating risk:

AI Based Approval: AI instantly analyzes sales data from the last 6 months for financing approval.

Saudi Payments Registration: Saudi Payments registers all funding against POS sales, preventing merchants from switching providers until repayment is completed.

Low risk Financing Cap: Financing is capped at 1.6 times the monthly average sales value.

Term Limit: The financing period is limited to a maximum of 12 months.

Automated Repayments: Repayments are automatically collected from daily POS sales.

Grow with Tasaheel

For POS Providers: Unlock New Revenue Streams

Partner with Tasaheel to enhance your platform’s value by offering seamless embedded finance solutions. Increase customer retention and boost transaction volumes with easy access to business funding directly through your POS system.

For SMEs: Fuel Your Business Growth

Access fast, flexible funding solutions tailored to your sales patterns without the burden of traditional loans. Tasaheel empowers your business with affordable capital to invest in inventory, expansion, or cash flow management—helping you thrive every step of the way.

For Funders: Discover Quality, Low-Risk Leads

Connect with a curated marketplace of vetted SMEs seeking funding, minimizing risk and reducing acquisition costs. Tasaheel’s platform delivers high-quality, data-driven leads that match your lending criteria, enabling smarter and more profitable financing decisions.

Ready to get started?

Join Tasaheel today and unlock new growth opportunities.